In the short time since I posted, I have tried to advance economic and social inclusion. Since July 8, I have only posted my stock portfolio. I invested in these companies solely on the basis that these stocks appear to have price and volume momentum, based purely on a mathematical algorithm developed recently by us. I have stopped writing in this blog and you may now view my portfolio updates in www.theedgemarkets.com. Enjoy!

Monday 29 September 2014

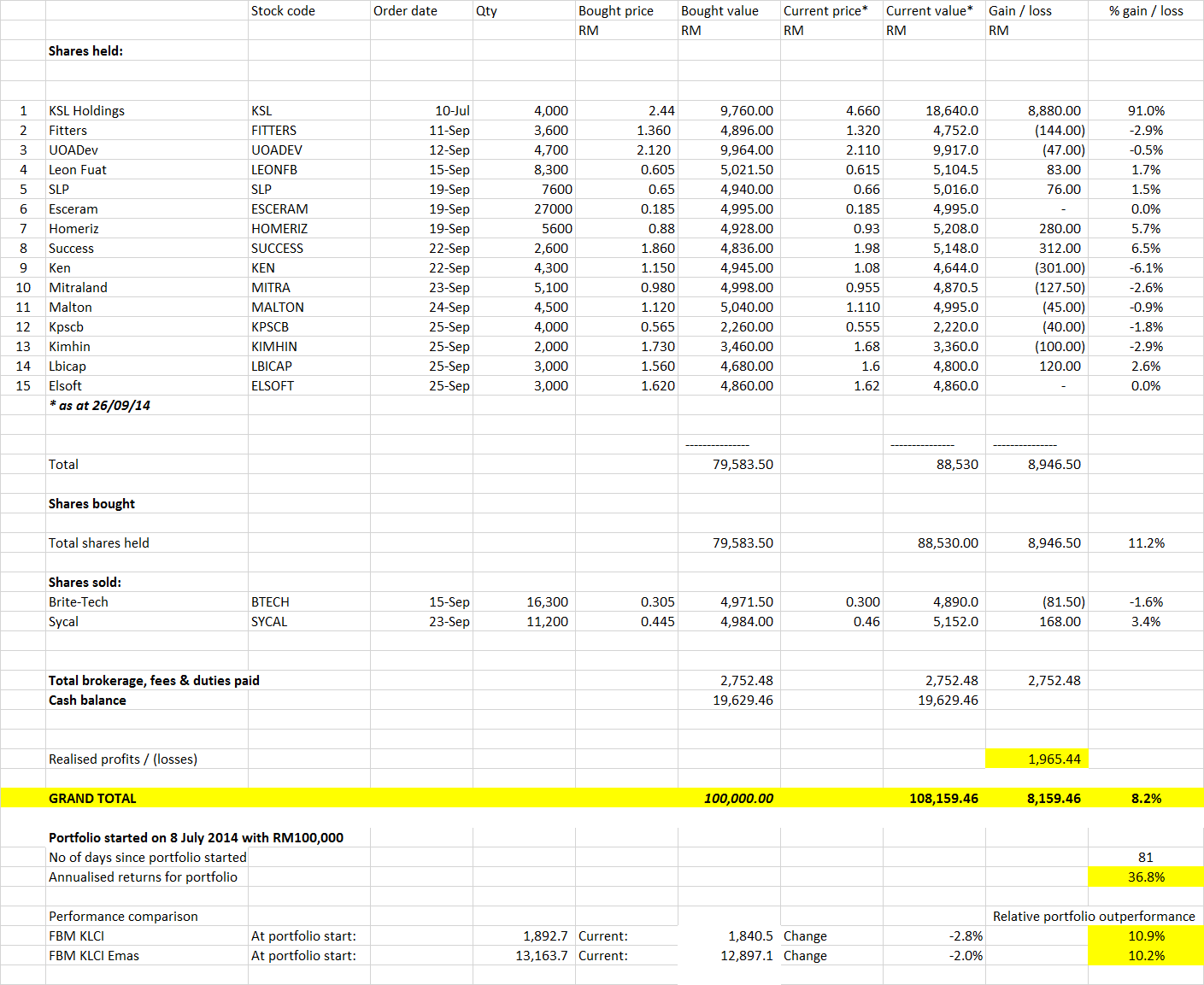

Tong Kooi Ong's Portfolio

Last Friday, my portfolio declined together with the broader market.

The portfolio value went down by 1.05% to RM 108,159.46 while the FBM KLCI decreased by 0.14%.

Total returns for the portfolio decreased from 9.3% to 8.2%.

The portfolio started on 8 July 2014 with a capital of RM100,000. Since then, it has outperformed the FBM KLCI by 10.9%, and has registered an annualised return of 36.8%.

Total profits currently stand at RM 8,159.46.

The gainers for the portfolio were LBI Capital (+2.6%) and Leon Fuat (+1.7). The stocks that lost ground were ES Ceramics (-2.6%) and Kim Hin (-2.3%).

There were no stock purchases last Friday.

The following shares were sold last Friday,

Brite-Tech: 16,300 shares at RM0.30 per share.

Sycal: 11,200 shares at RM0.46 per share.

Friday 26 September 2014

Tong Kooi Ong's Portfolio

On Thursday, my portfolio declined while the broader market picked up.

The portfolio value went down by 0.74% to RM 109,306.48 while the FBM KLCI increased by 0.16%.

Total returns for the portfolio decreased from 10.1% to 9.3%.

The portfolio started on 8 July 2014 with a capital of RM100,000. Since then, it has outperformed the FBM KLCI by 11.9%, and has registered an annualised return of 42.5%.

Total profits currently stand at RM 9,306.48.

The gainers for the portfolio were Success (+2.6%) and SLP (+1.5%) and Fitters (+1.5%). The stocks that lost ground were Ken (-2.7%) and KSL (-2.7%).

The following shares were bought yesterday, following the pick-up in trading momentum:

KPS Consortium Bhd (Stock code: 9121): 4,000 shares at RM0.565 per share. The company is principally engaged in the manufacture of various types of tissue-related products It also distributes and retails wooden doors plywood and related building materials. The company offers good valuation as it is trading at 0.4 times book and at a price to earnings multiple of 9 times.

Kim Hin Industry Bhd (Stock code: 5371): 2,000 shares at RM1.73 per share. The company produces range of ceramic floor and wall tiles. It has seen a rebound in earnings in the current year and is currently at a discount to its book value. It is also in a net cash position.

LBI Capital Bhd (Stock code: 8494): 3,000 shares at RM1.56 per share. Principally involved in property development and property investment, the company has good net margins with a stable turnover and a fair valuation as it trades at P/B of 1 and PE of 7.

Elsoft Research Bhd (Stock code: 0090): 3,000 shares at RM1.62 per share. It is an MSC-status company that provides ATE solutions to the semiconductor optoelectronic and automation industries. The company has high EBITDA and net margins of 40% and is in a net cash position.

The following shares were sold yesterday,

K.Seng Seng: 10,800 shares at RM0.705 per share.

Heveaboard: 2,500 shares at RM1.93 per share.

Thursday 25 September 2014

Subscribe to:

Posts (Atom)

.png)

.png)

.png)