Making money is great. But keeping the money you made is critical.

In

capital markets where non-equity investments are less sophisticated, many of us

would look at some risk diversification within our equity portfolio.

This

is what we have decided to share this week.

Singapore

Telekom (SingTel) is the largest listed company on the Singapore Exchange by

market capitalization and 51.88% owned by Temasek Holdings, the investment arm

of the Singapore Government.

It

controls 47% market share of the island’s telco business. It has diversified regionally into Indonesia,

Philippines, Thailand, Bangladesh, India, Malaysia, Sri Lanka and Africa and now

serves a total of 468 million mobile customers.

It

is trading at a low valuation of less than 17 times price to earnings, much

lower than all its smaller competitors in Singapore and Malaysia. We believe

this reflects the weaker earnings for this financial year due to forex losses

from the weaker currencies of Australia, India, Thailand and others relative to

the Singapore dollar as well as operational challenges at Optus, its Australian operations.

Despite

paying a competitive dividend yield, its dividend payout ratio is only 75% of the profit it makes. As a result, the Company is

able to invest strongly in capital expenditure, amounting to 12.5% of its revenue each year. This is an industry of rapid technological

changes and to stay ahead, companies must be able to make huge investments.

For

those who are more interested in a pure Singapore play, then the alternative is

M1. Its earnings will grow as it is the first operator to offer nationwide 4G services

and it is focused on the mobile business. At current prices, it offers a yield of

4.9%.

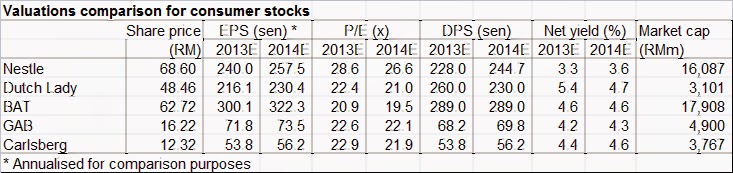

As a comparison, the yields for the very safe and large consumer companies listed on Bursa are in the range of 3.6% to 4.7%. These are companies like Nestle and British American Tobacco. These companies are extremely well managed with excellent track record on governance and transparency. Their earnings are very stable and are market leaders for their products.

SingTel is both a growth and defensive stock, pays a Sing dollar dividend yield of 4.5% and is trading at a reasonable valuation. SingTel is definitely worth a closer look for anyone looking to mitigate risks in their existing stock portfolio.

There is, however, no need to rush as it is a huge company and the stock is unlikely to go up by 10% like what happened to Daiman last week.

This article is published in the upcoming Edge.